APOB Registration

What is APOB?

(Additional Place of Business)

APOB refers to any location beyond your main business address (PPOB)—like a warehouse, dark store, dispatch hub, or rented space—used to store or ship goods under GST.

For e-commerce sellers on platforms like Amazon, Flipkart, Blinkit, Zepto, Meesho, and Myntra, these secondary locations must be declared under GST. Failing to do so makes your operations non-compliant, prevents order dispatches, and risks suspension or penalties

APOB refers to any location beyond your main business address (PPOB)—like a warehouse, dark store, dispatch hub, or rented space—used to store or ship goods under GST.

For e-commerce sellers on platforms like Amazon, Flipkart, Blinkit, Zepto, Meesho, and Myntra, these secondary locations must be declared under GST. Failing to do so makes your operations non-compliant, prevents order dispatches, and risks suspension or penalties

Benefits & Uses.

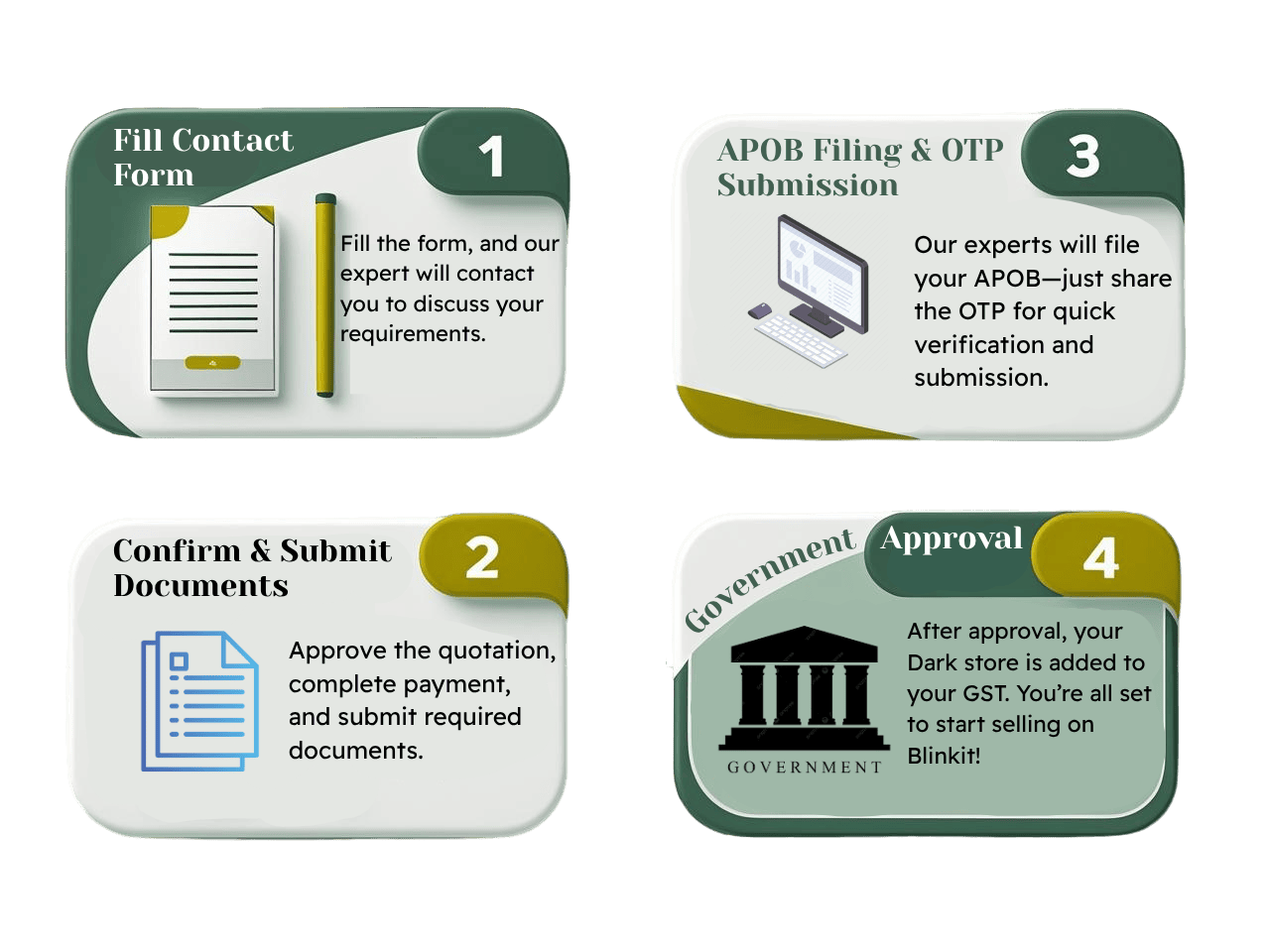

Process

CONTACT US

Documents Required

All Services